Stamp Duty reforms have saved average of £1,500 per purchaser

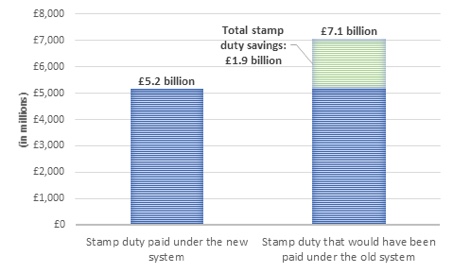

UK home buyers have collectively saved £1.9bn since Stamp Duty Land Tax was reformed in December last year.

The calculation is by conveyancing firm My Home Move, made by analysing the transactions it dealt with between December 4 last year and November 27 this year.

Its analysis shows that home buyers are saving an average of £1,500 each since the reforms.

The reforms abolished the old ‘slab’ system of Stamp Duty and benefited anyone purchasing a home priced under £937,500.

Almost nine in ten (87%) of estate agents recently polled by My Home Move said that last year’s Stamp Duty changes have had a positive impact on the market.

Doug Crawford, CEO of My Home Move, said: “The big winners from the changes have been the first-time buyers and second steppers who have really struggled from price hikes due to a lack of housing stock.

“Cheaper Stamp Duty bills don’t fix all the problems facing these buyers, but they do help by making it easier to save for a deposit.

“The old ‘slab’ system was ripe for reform as it was creating a stranglehold over the market, especially where property prices neared the Stamp Duty thresholds, and in particular around the £250,000 mark.

“Thanks to the reforms, people are now able to sell their homes for a truer value.

“However, there are those who have lost out from the changes.

“There is a small minority of buyers who are looking for luxury homes or expensive London properties which now command up to 12% in Stamp Duty.

“With a slowdown now being felt towards the top end of the market, it could cause a worry for the Government as receipts from Stamp Duty start to fall.

“However, following the announcement of a 3% Stamp Duty surcharge for buy-to-let investors, any deficit could be offset from April.”