← Back to News

Posted on January 18th 2022 by movingin-adm

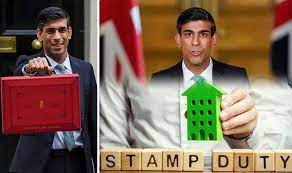

Memo to government: Slash stamp duty surcharge to get more rental units

Politicians who express concern over the number of holiday lets and Airbnbs in tourist areas miss one major point – if they slashed stamp duty on buy to lets, they would actually increase the mainstream rental supply they claim to worry about.

That’s the message from ARLA Propertymark, which has been responding to a recent Parliamentary debate over the detrimental impact of short lets in particular on some key tourist areas such as the west country and the Lake District.

South Lakes MP Tim Farron – a former Liberal Democrat party leader – has led a debate in the House of Commons on what he calls “the housing crisis created by excessive second home ownership.”

He presented a seven point plan to limit the number of second homes and make more affordable homes available for local families: these included making second homes and holiday lets new and separate categories of planning use, and strict new taxes on such properties.

The proposals won broad agreement from individual MPs from the Conservative and Labour parties, too.

“It is therefore vital that policy makers understand that the short-term rental market is growing in attraction for many existing and new landlords given its tax and regulatory framework, risking the availability and affordability of private rented sector homes.

“During the debate, several references were made to the role of Stamp Duty Land Tax and the additional three per cent surcharge on purchases of additional homes. However, it was disappointing that no-one took the opportunity to acknowledge that the additional three per cent is actually a barrier to investment for much needed homes in the private rented sector.

“The UK government need to urgently look at the tax loophole that permits owners to register for non-domestic business rates instead of Council Tax and to level the regulatory playing field so that short-term providers are subject to the same expectations as long-term providers in the private rented sector.”